A wide variety of FMCG and Agri products are made available at low prices at Ready-Fi Touch Point. The products need to be can be pre-booked with the Ready-Fi retail merchant. Special campaigns and offers are run regularly at the Ready-Fi retail outlets for generating experiences and trials.

Targetting the surplus :

Agriculture Most of the centers in the tier 3 districts and blocks have large walkins from the farming community for regular govt services. We enable addition of insurance, farmer loans through tie-ups with rural banks and insurance companies.

Benefit to Microentrepreneur :

Multiple out of the box services to be sold as an add on to the farmer, for eg. Under subsidised crop Insurance (PMFBY) , around 2 Lakh farmers enroll in a district every season with commission of over 25 Rs per farmer.

- PMFBY( Fasal Bima Yojna)

- Farm crop loan

- Paid advisory Services

- PM Kisan

- Interest Subvention Scheme

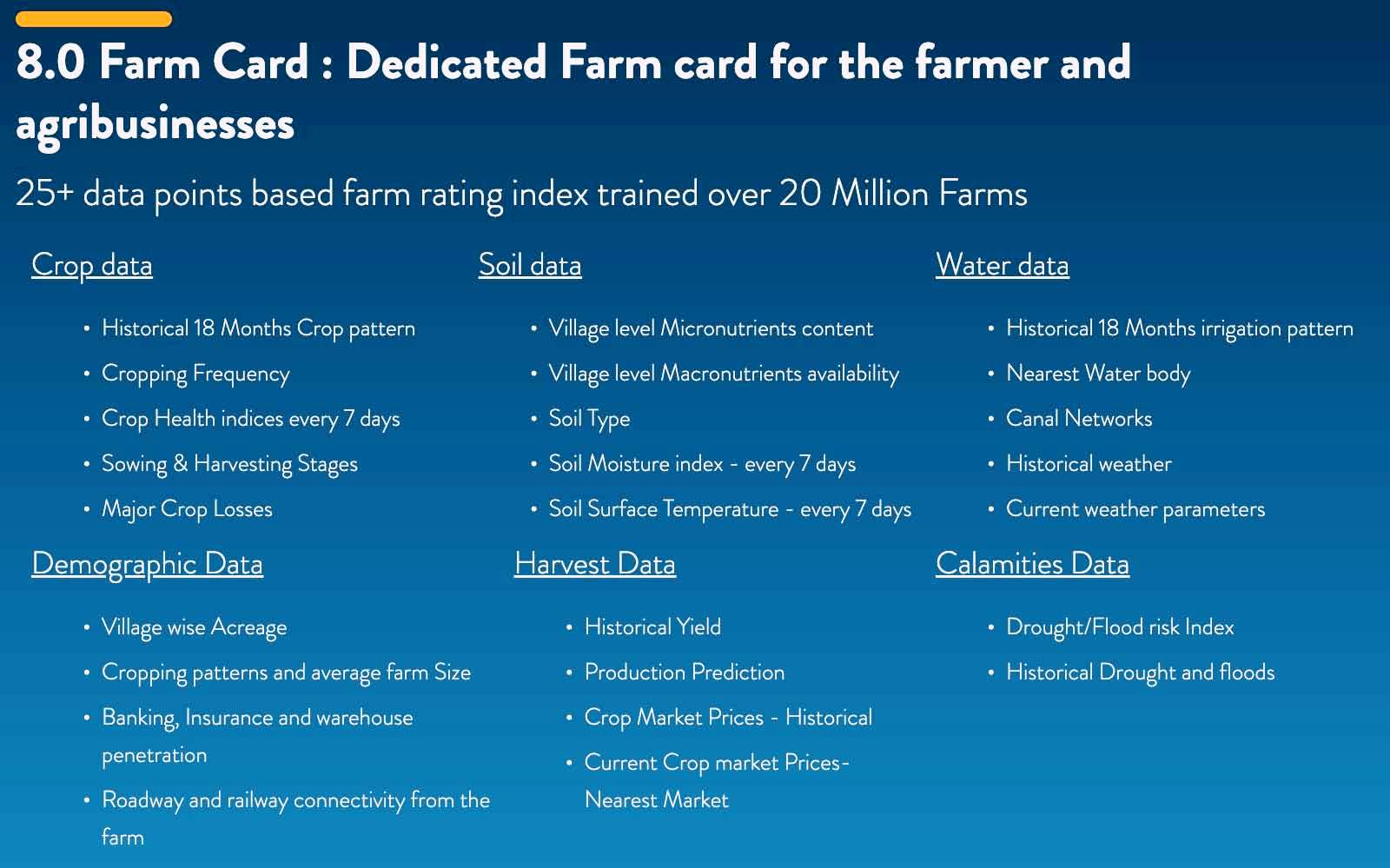

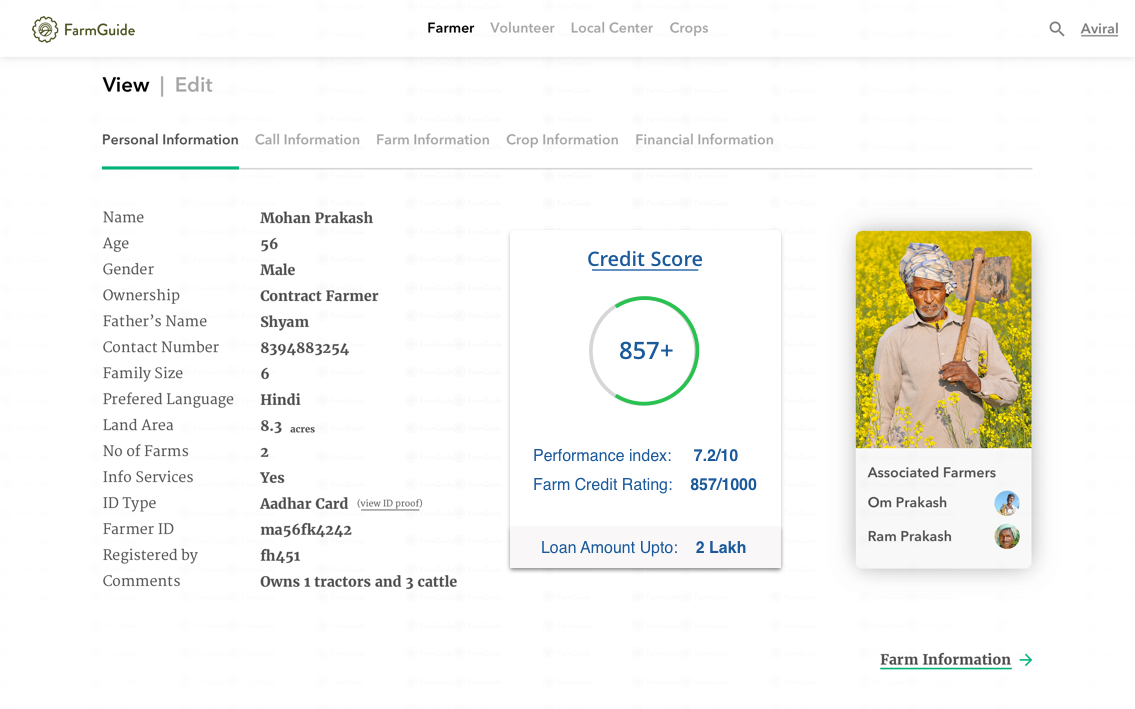

Farmer Credit Score

FarmGuide is developing a digital infrastructure of ISS for Government of India to initiate a nation-wide coverage of farmers which will integrate them with financial infrastructure.

Credit is a critical input in achieving high productivity and overall production in the agricultural sector. The Cabinet approved a sum of Rs.20,339 crore under ISS (interest subsidy scheme) to meet various obligations arising from interest subvention being provided to the farmers on short-term crop loss. To assist the scheme, we need a technological solution to monitor the short-term credit minutely.

After our proposal presentation, we were chosen for developing and maintaining the software solution under a 3 year contract for creating a digital system for implementation of interest subsidy scheme, which is a centralised solution for all institutional lenders registered by RBI and NABARD. A work order for the same is assigned to FarmGuide by Government of India to create the discussed digital system for interest subsidy scheme covering all short term credit loans in India.

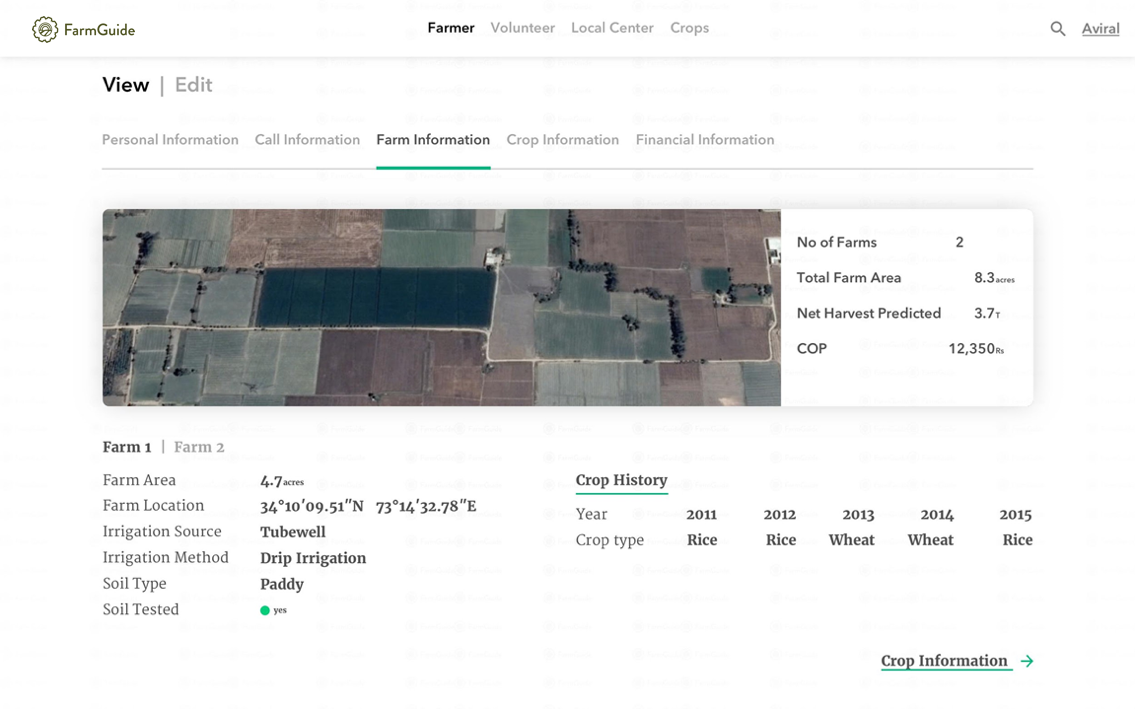

We believe the agricultural lending in India has always been surrounded with insecurities where the bankers' intent to help farmers has been met with opposition and suspicion for the longest time. In order to help financial institutions determine credible farmers, FarmGuide is giving credit score to each farmer to ensure efficient disbursal of agricultural loans based on the credit score.

The credit score is calculated using farmer's profile which contains data like farm size, Aadhar and phone number, loan history, crop grown, irrigation status and other farm land parameters. The risk attached to the crop that the farmer is planning to sow this season is also taken into account.

How is it helping stakeholders?

Insurance companies

Apart from understanding the credit risk associated for a particular farmer, this will also boost coverage by insurance companies. Since the crop insurance under Pradhan Mantri Fasal Bima Yojana (PMFBY) is linked to availing of institutional crop loans, the farmers would stand to benefit from both farmer oriented initiatives of the Government by accessing the crop loans.

Microfinance institutions

Micro financing is a frugal approach to address credit crunch in rural market. Through our centralised system, we plan to collaborate with microfinance institutions to find the thrust areas, enabling them to monitor premium collection and registration through our solutions. This will reduce the product designing cost and ensure credit availability as per the financial needs of each farmer.

Banks

We provide banks with an objective, independent and reliable opinion on credit quality of farmers. This serves as an additional input in the credit decision making process, assists in risk pricing and capital allocation and facilitate portfolio management and monitoring.

Agri SME

We are enabling prospective/existing lenders to negotiate better terms on the basis of credit rating, reducing the time involved in obtaining loan approvals. With this, the agri-SMEs can project a better image to prospective/existing trade partners, carry out self-evaluation and take timely and corrective measures for improvement.

Farmers

Accessibility of government interest subsidy schemes and eligibility of credit schemes are major concern for the farmers. We aim to aware farmers about available options for credit offered by banks, cooperative societies and microfinance institutions. This, in the long run, would help farming community to be aware about institutionalised credit before opting for local lenders.

Government

An independent evidence-based system and centralised credit monitoring system with details upto the farmer level is essential and will help in policy designing and supervision. This will reduce the inclusion/exclusion error with two-way communication about the policy impact.

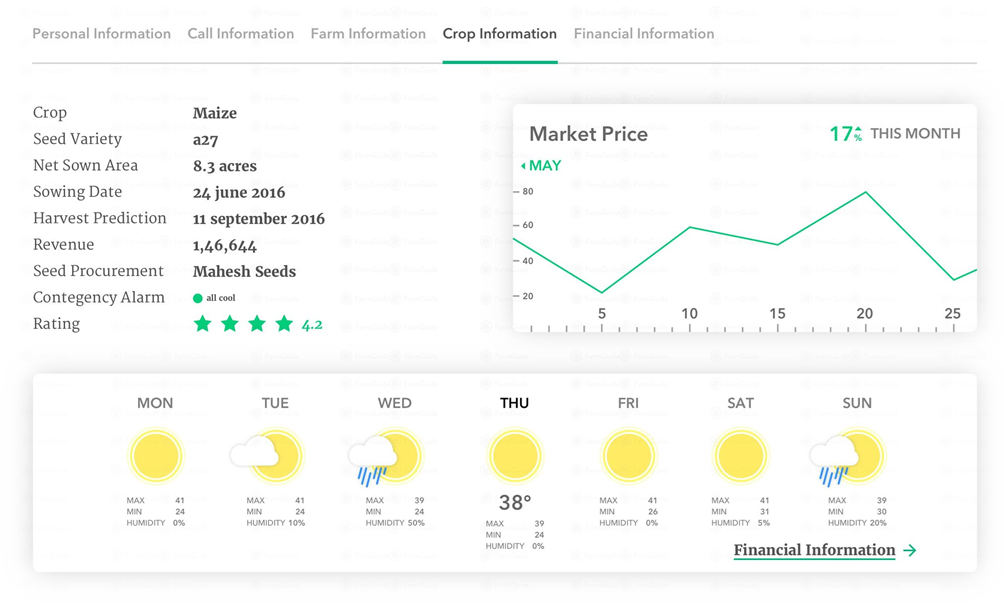

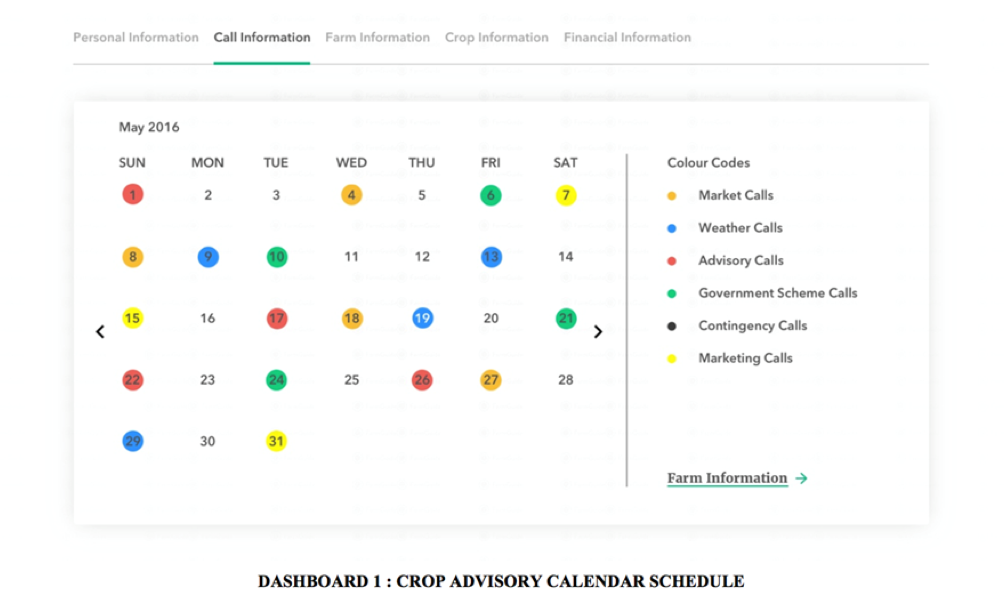

Crop Advisory

Challenges to agriculture, posed by ever increasing demand for food supply coupled with climate change, call for innovative and smart decisions. FarmGuide is using data science models to support farmers who are at the forefront of this decision-making process. These models will provide farmers with agricultural solutions through pre-scheduled and pre-recorded voice call (IVRS).

The other stakeholders including harvest buyers, warehouses, logistics & supply chain, machinery suppliers and insurance companies can use the platform for marketing schemes, new products and reaching out to the specific customer or harvest seller in the desired location

Many organisations are working towards creating information channel, but scalability, affordability and customisation of the solution are yet to be accomplished. We recognised that the existing mode of communication such as SMS can’t be a one fit solution, which triggers the need for a toll free number and application to ensure effective flow of customized information to farmers.

By providing farmers with nuanced information through our toll free number, we are enabling a two-way approach that ensures effective conversation. Our system hinges on data analytics to provide precise information to farmers.

Value Addition to the stakeholders

CSR initiatives

The rural areas are in dire need of exposure to government schemes, products, health benefits etc. We encourage corporate social responsibility by businesses that are willing to sponsor crop advisories for farmers

Self help groups

The NGOs can sponsor info services for farmers and connect with the farmers on daily basis through calls to spread awareness about added benefits/schemes/events organised by them.

Input supplier

The input providers can engage with the farmers to train them about their products such as seeds, fertilizers and farm mechanization equipments. Through our web dashboards, they can see the real-time performance of their products at farm level.

Financial institutions

Increasing NPAs and high administrative cost involved in updating farmers about regular premium payments is a concern. We help lending institutions in channelising communication with loanee farmers about their financial profiles through calls/premium updates .

Crop Insurance

Crop Insurance is currently covered under Pradhan Mantri Fasal Bima Yojna (PMFBY) and Restructured Weather Based Crop Insurance Scheme (WBCIS) in India. These schemes mandate loanee farmers to have an insurance, where farmer is charged upto 2-5% of premium and the balance premium is shared equally between central and state government.

Our crop insurance software solution is a dynamic platform which digitises the data to ensures flow of information between banks, insurance companies and other stakeholders on real-time basis, facilitating speedy delivery of insurance claims and reduction in scope of human error in the process.

Though PMFBY has improved upon the previous insurance schemes by bringing more non-loanee farmers under its coverage, the process is linear and paper-based. This results in a very opaque system for farmers and limited scope for addressing agrarian distress.

But, we believe no farmer should be devoid of the financial security and stability that comes with crop insurance. By digitising the process, we are trying to make that experience for farmers and other stakeholders convenient and more effective through DBT.